While it is difficult to predict what lies ahead for the hi-tech industry in 2023, it seems a certainty that the heady days of 2020 and 2021 – days when a due diligence process was measured in days or hours versus months, where massive multibillion-dollar super funds funneled money into broken business models, and growth was the only metric that mattered – are gone and won’t be returning.

According to IVC, the Israeli tech ecosystem has already seen a dramatic 70% reduction in funding in the second half of 2022, from nearly $14B in H2 ’21 to $4.6B in H2 ’22. As capital suddenly becomes scarcer, many startups will be in a position they have never encountered – struggling to raise. While undoubtably there will be businesses that are forced to shutter, the Israeli market is going to witness a great wave of M&A and consolidation in the tail end of 2023 and 2024.

Perfect Storm of Factors

For those who have been following the broader market and macroeconomic conditions, the above prediction should come as no surprise. There is a confluence of factors conducive to a supercharged M&A environment.

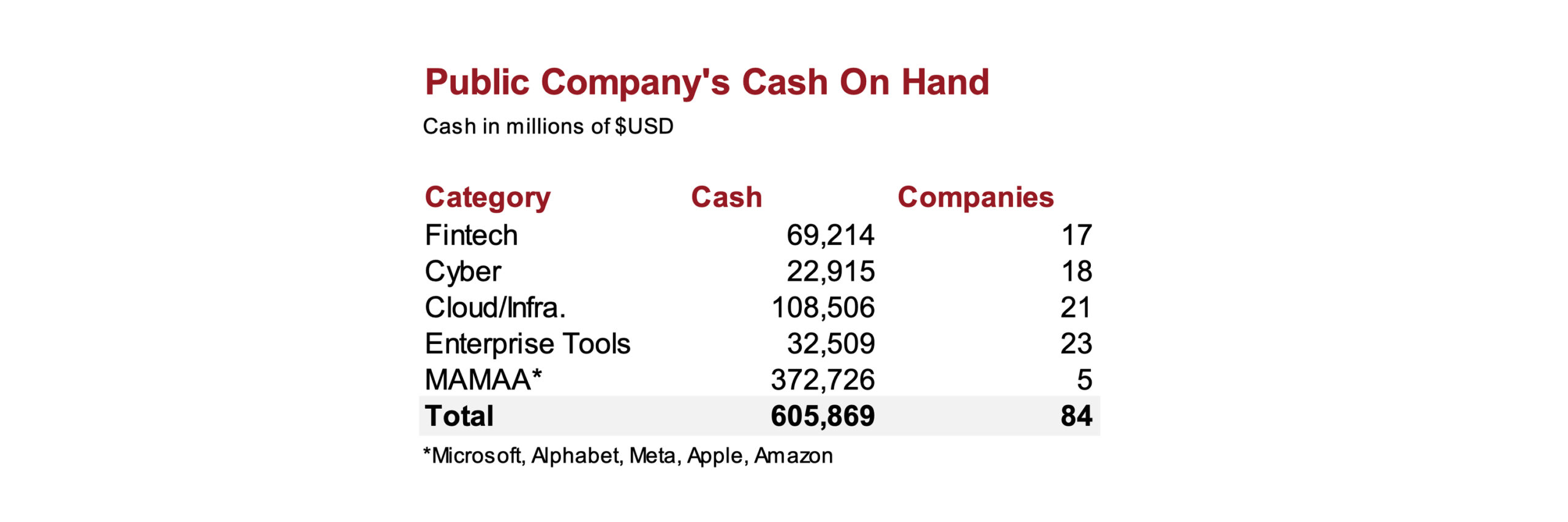

The first is the significant amount of dry powder, or investable capital, sitting on the sidelines. According to Preqin, Private Equity firms have record levels of commitments from LP’s, with the number approaching $2 trillion dollars[i]. While it is important to note that this doesn’t always translate to investable dollars, it provides an indication of dealmaking capacity. Likewise, corporates, coming off an epic ten-year bull market, have their coffers full and slowing growth, wall street pressure, and a nose for dealmaking will drive strategics to pursue new opportunities[ii].

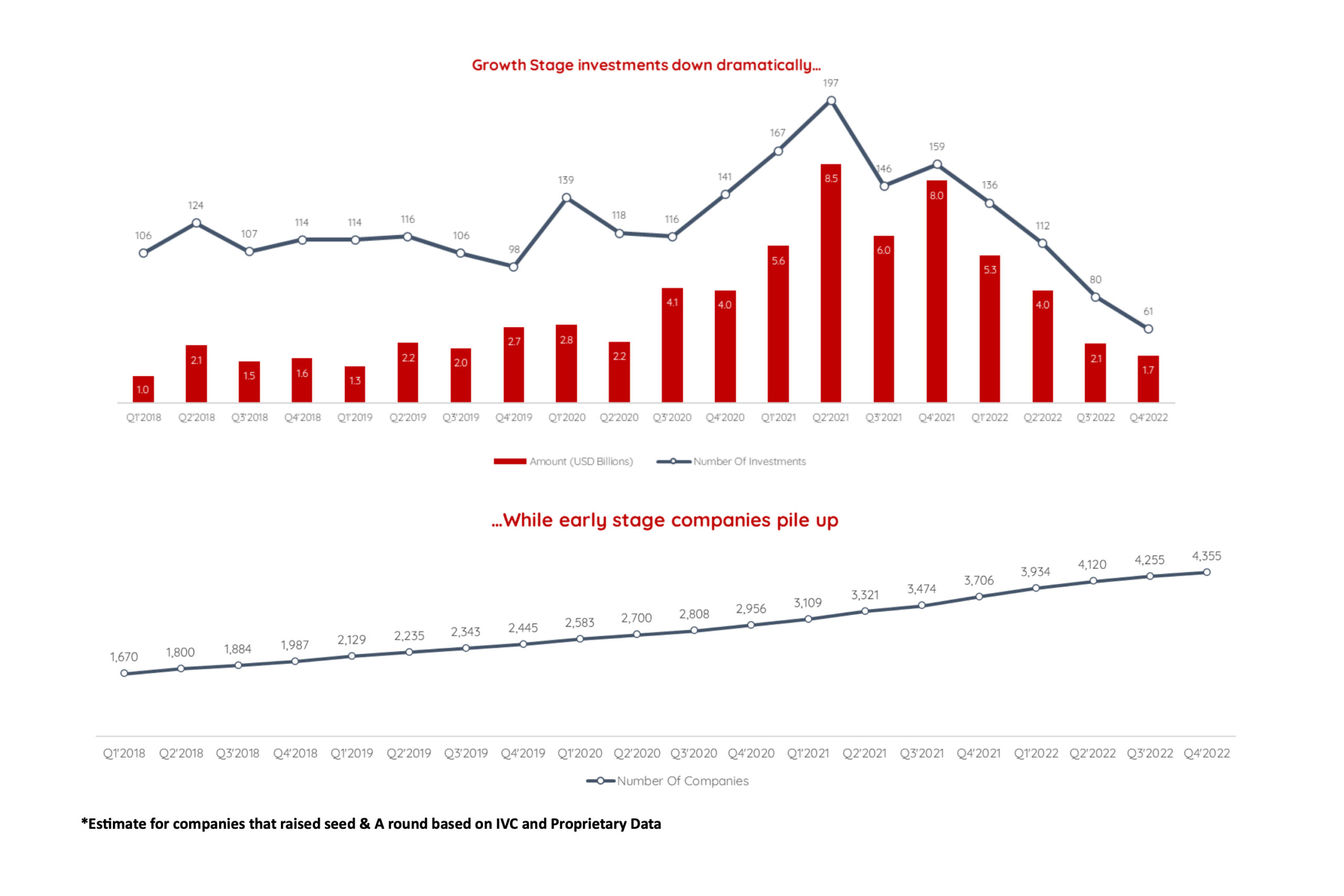

Finally, the combination of falling valuations in parallel with a significantly more difficult growth-stage fundraising environment will serve as a catalyst for increased dealmaking. From the acquirer’s point of view, declining valuations will make M&A more attractive as the ROI becomes clearer. From the acquisition target’s perspective, pressure from slowing growth and worsening KPIs will force management and boards to consider a strategic exit as capital markets remain closed in the coming quarters.

Israel’s Overheated Ecosystem

While these broader trends will also play out in the startup nation, we see a more specific Israel-related reason for the coming M&A wave: over funding.

Perhaps more than anywhere else outside of Silicon Valley, Israel benefited from the technology investing frenzy. Over 2020 and 2021, Israeli funds raised a record $10B of cash[iii]. In turn, they invested unprecedented levels of capital into record numbers (779 and 600, for ’21 and ’20 respectively) of deals and businesses.

In parallel, global mega-funds flooded the market with cash, leading valuations to spike and forcing competing funds to find alternative deals, often in the same overhyped spaces. As a result, the absolute number of startups increased significantly just as growth stage investors begin to pullback and be more selective in their investments. In other words, we will see more companies fighting over fewer dollars forcing some companies to find a soft-landing for their business should they not manage to raise.

Over-funded and over-concentrated sectors face pressure to consolidate

Over-funded and over-concentrated sectors face pressure to consolidate

With so much money pouring into a (relatively) small ecosystem, it’s no surprise that some verticals produced several duplicate companies which have overlapping products, use cases, and customers. We argue that the three verticals which originated numerous duplicate businesses, FinTech, Cyber, and DevOps, are ripe for consolidation.

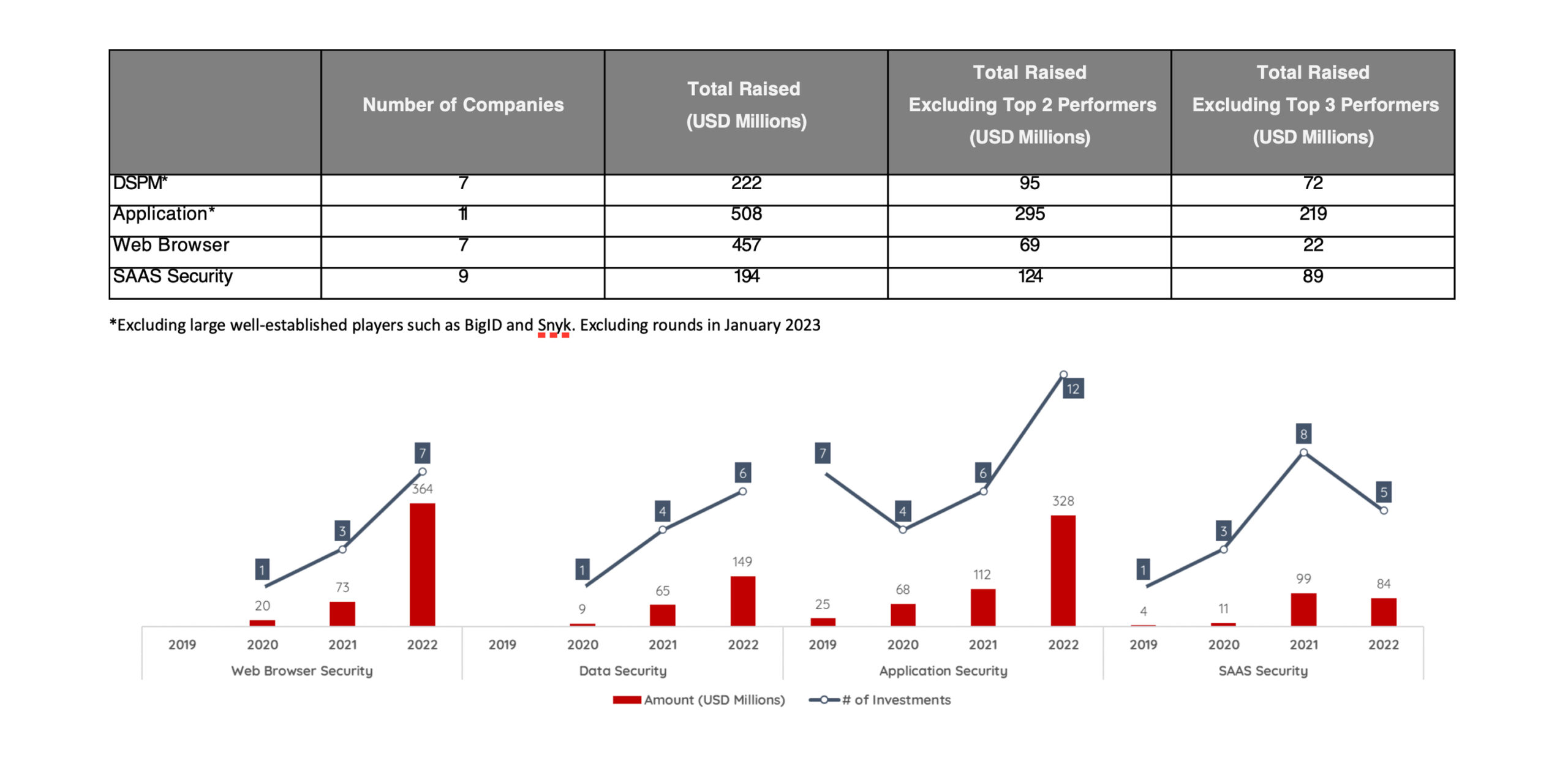

One glaring example of this is the Data Security (or DSPM) space. No less than seven companies were founded in the segment (Cyera, Sentra, Laminar, Eureka, Polar, Dig, and Flow) and have raised over $200 million over the last three years. More to the point, approximately 70% of the funding went to three out of the seven companies, giving them a potential leg-up over competitors. While most experts and CISOs agree that DSPM will be an important category, all agree that the market isn’t nearly large or mature enough to support this many companies. And this analysis doesn’t include companies such as Palo Alto Networks, Wiz, and BigID (not to mention American companies) which are all building products in the DSPM space.

A similar pattern emerges when you look at Application Security, including sub-segments such as supply chain security (Legit, Apiiro, Cider, Scribe, Jit, Cycode) and SaaS security (Wing, Atmosec, DoControl, Grip, Astrix, and Adaptive Shield, amongst other). In the supply chain segment, many companies compete both with each other as well as with adjacent companies like Snyk and ASPM providers. Overlapping solutions will find it difficult to sell in a crowded market, especially as CISO’s face pressure to consolidate their cyber stack and rein in spend. Already, PaloAlto made headlines for its acquisition of Cider (after considering Apiiro) and Jfrog has added an open-source solution to their offering. We expect other larger cyber companies to add an AppSec product through an acquisition.

In fintech, numerous companies in the overlapping payments, spend, and expense management spaces (from the larger Tipalti, TripActions, Rapyd, and Melio to the smaller Mesh, PayEm, Balance, and Stampli), raised significant amounts of money during the market hype and face off against much larger and better funded competitors such as Bill.com, Coupa, Ramp, and others. This competition could play out in decreasing take rates from transaction fees and commoditization of the payments infrastructure. Already we have seen some M&A (Bill with Divvy, ThomaBravo with Coupa) which may translate to increased pressure on the other players to expand their product suite or get rolled into a larger platform.

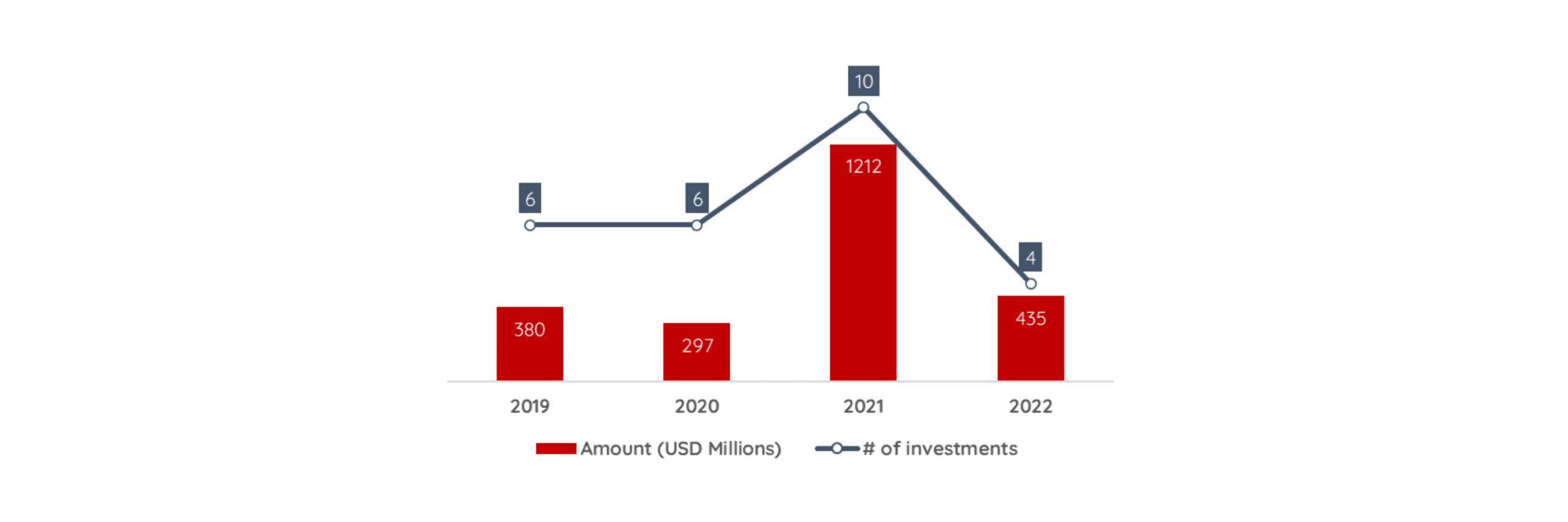

Lastly, the Devtools market is overdue for massive consolidation. During covid, investors chased tools that promised to make developers more efficient, speed up the development process, and otherwise improve the CI/CD process. Yet, as many of the founders and their investors admit, many of these companies are features – not stand-alone platforms – giving them smaller TAMs and more difficult GTMs. However, since most of teams are stellar and relatively lean, it’s not hard to imagine acquisitions occurring as larger enterprise SaaS, cloud, and other public companies look to expand their product offering or build out an office is Israel via an acquihire.

In conclusion, we expect the worsening macro backdrop to put further pressure on the Israeli technology ecosystem. While most companies are tightening their belts, founders and boards should ask themselves to what end are they surviving and if they foresee a viable, standalone business when their 24 months of runway comes to an end. With other companies doing the same calculations, some companies may even want to begin positioning themselves for an acquisition now.

[i] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/global-private-equity-dry-powder-approaches-2-trillion-73570292

[ii] Factset Data

[iii] https://www.gkh-law.com/wp-content/uploads/2022/06/IVC-GROSS-Investors-Report-2021_final_15_June-002_Design-002.pdf