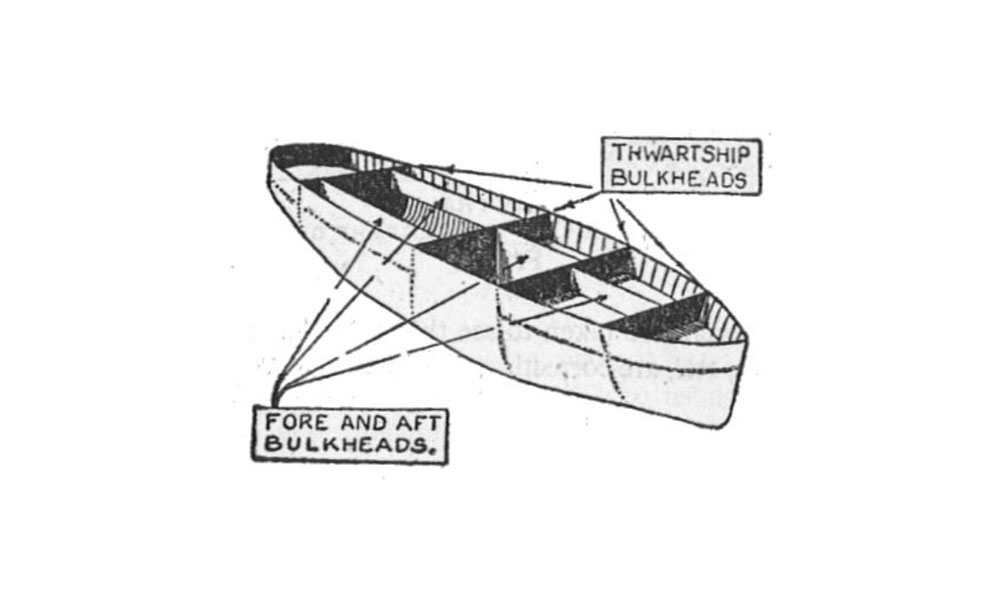

When Pavel Gurvich wants to illustrate micro segmentation for protecting complex hybrid cloud environments, he uses a simple example taken from the traditional Shipbuilders world. And that’s what I love about him. Using a down to earth, no frills approach, he instantly made me get it. Area security is not going to cut it anymore. Micro segmentation, which will isolate workloads is the future of security. It’s that simple.

Pavel and I first met in 2015 through the introduction of Gil Goren, then SVP & Managing Partner at EMC Ventures International. Gil was extremely enthusiastic about Guardicore and insisted that I must meet with Pavel if Cyber security is of any interest to Qumra. Obviously, I was intrigued by the warm recommendation and happily met with Pavel. The click was immediate. Though the company was in its early stages and way too early for a growth fund, I was deeply impressed with Pavel’s clear vision, open approach and managerial skills. Pavel cleverly built a leadership team that is aligned around the goal of building the best security platform and growing the company.

Since then I have followed Guardicore’s progress and its financing rounds and was pleased to see the list of impressive investors demonstrating their confidence in Pavel and in the company. But Guardicore was still too early for a Qumra investment.

Fast forward to 2018, I met with Amir Rosentuler who was an advisory Board member at Guardicore. Amir shared positive updates about Guardicore’s plans and progress. I knew then that the time has come for us to lead the next financing round. Amir put us in touch again and the click was still there. And when the time was right for Guardicore, Pavel reached out to me. My impression of him and the company he had built, has only strengthened with the passage of time. I was convinced he had all the makings to lead a growth company. Great technology, proven market fit, large market opportunity and an amazing executive team to orchestrate it all.

Guardicore is disrupting the traditional firewall market by providing fine grained segmentation for greater attack resistance, servicing clients like Microsoft, Deutsche Telekom, Comcast, Santander and other top tier firms. At a time where enterprises are moving to the cloud and creating complex hybrid environments, attack surfaces are being multiplied. Legacy products aren’t enough. Companies are adopting DevOps and seeking velocity and agility, yet Firewall vendors have not adapted to the new IT stack. This is creating a great opportunity for micro segmentation, which reduces risk and enables compliance while preserving agility and velocity.

While the concept of network segmentation is not new, Guardicore has taken this to the next level by creating secure zones in data centers and cloud deployments that enable companies to isolate workloads from one another and secure them individually. This is achieved through comprehensive security controls, operated simply and intuitively. Remember the shipbuilder?

The Micro segmentation market is currently valued at $1Bn and expected to reach $3.8Bn by 2025. Driving this growth are growing usage of security virtualization and cloud computing, increase in network connectivity, data theft and ransomware attacks.

As a growth fund, we are on the lookout for companies that have already achieved late stage status. The developments in Guardicore clearly positioned the company as a suitable candidate for a growth investment.

Since 2018 we have begun to see some very exciting developments both in terms of financing rounds and exits which provide an indication of market maturity. The Checkpoint-Dome9 and CyberArk-Vaultive deals are notable since both acquirer and acquiree are Israeli. The recent acquisitions of Demisto by Palo Alto networks and Luminate by Symantec are additional testaments of maturing Israeli Cyber Companies.

The average size of investments in Cyber security companies has almost doubled over the past year, enabling companies to grow and stay private longer before exiting. This is in line with the global trend of funding shifting into later rounds to fuel growth and expansion. In 2018, there were several Israeli private Cyber companies raising above $50M, among which were Claroty and Aqua security.

We are proud to have led the $60M Series C funding of Guardicore, together with Deutsche Telekom , Partech and ClalTech, and join forces with existing investors Battery Ventures, TPG Growth, 83 North and Greenfield partners. We are even prouder to have Pavel and the Guardicore team as part of the Qumra portfolio.

Israel’s cybersecurity industry has long achieved recognition as a thriving hotbed of innovative solution. Its time the market gains recognition for its maturity and we are looking forward to joining Guardicore’s journey in building a world class Cyber security company.

Super interesting, Boaz. good luck!